are corporate campaign contributions tax deductible

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Consider the Presidential Election Campaign Fund.

Ymca Reply Donation Card Not For Profit Direct Mail Campaign Annual Appeal Fundraising Campaign Design Direct Marketing Examples Fundraising Campaign

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529.

. And the same goes for a business return. On federal tax forms taxpayers can check a box to direct 3 to the fund the sole source of public money for presidential campaigns. Every business type with the exception of traditional C corporations pays taxes as a pass-through entity.

Reg 1513-4 c 1 defines a qualified sponsorship payment as any payment of money transfer of property or the performance of services by any person engaged in a trade or business where there is no arrangement or expectation that the person will receive any substantial return benefit in exchange for the payment. And businesses are limited to deducting only a portion. Are Political Contributions Tax-Deductible.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Among those not liable for tax deductions are political campaign donations. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. They may be deductible as trade or business expenses if ordinary and necessary in the conduct of the taxpayers business. A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return as described in Publication 597 PDF.

Most political contributions whether local regional or national are not tax deductible and havent been for years. All types of contribution besides money like time service and tangible goods donations are called in-kind contributions. Except as indicated above contributions to a foreign organization are not deductible.

Individual donations to political campaigns. In other words you have an opportunity to donate to your candidate campaign group or political action committee PAC. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Reliance on Tax Exempt Organization Search. So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the Internal Revenue Code of 1954.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contribution on the part of the donor. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. The current fund balance is 369168988.

In 2016 the fund disbursed only 3474862. The funds do not affect your taxes or your deductions. This means the businesss taxes are passed along to the companys.

You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate. The contributions to an HSA are tax-deductible and the accounts earnings if invested are tax-free as are withdrawals for eligible medical expenses. Only those donations or contributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax.

All four states have rules and limitations around the tax break. The IRS has clarified tax-deductible assets. Whatever means a political contribution is made - via money or in-kind donation one cannot deduct it.

Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax. Is It Tax Deductible.

Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform. Today about 4 percent of taxpayers check that box. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

Business deductions for charitable contributions may be limited and the deductions may only be deductible for the individual owners rather than the business itself. Those that choose to join a campaign group or political. According to the IRS the answer is a very clear NO.

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma

Are My Donations Tax Deductible Actblue Support

Pro Trump Group Falsely Claims Donations Are Tax Deductible

Tax Policy Changes And Charitable Giving What Fundraisers Need To Know Ccs Fundraising

Are Political Contributions Tax Deductible H R Block

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Template Donation Letter Donation Thank You Letter

Tax Deductible Donations Institut Pasteur

Are Political Contributions Tax Deductible Anedot

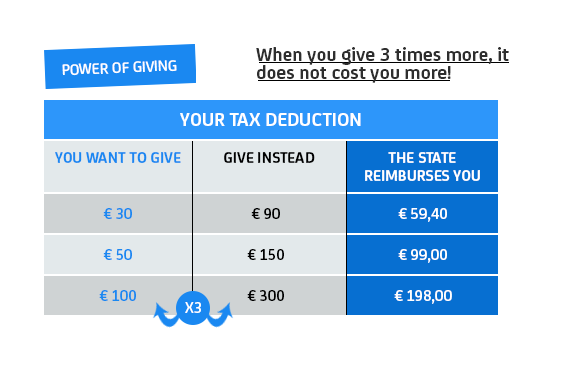

Tax Deductions For Donations In Europe Whydonate

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible Smartasset

How Much Should You Donate To Charity District Capital

Are Political Contributions Tax Deductible Smartasset